MT UI-5 2014-2024 free printable template

Show details

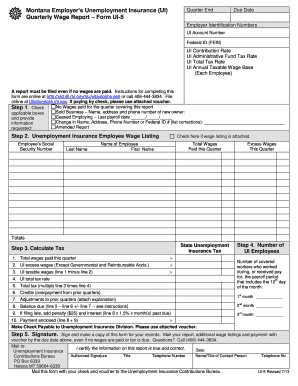

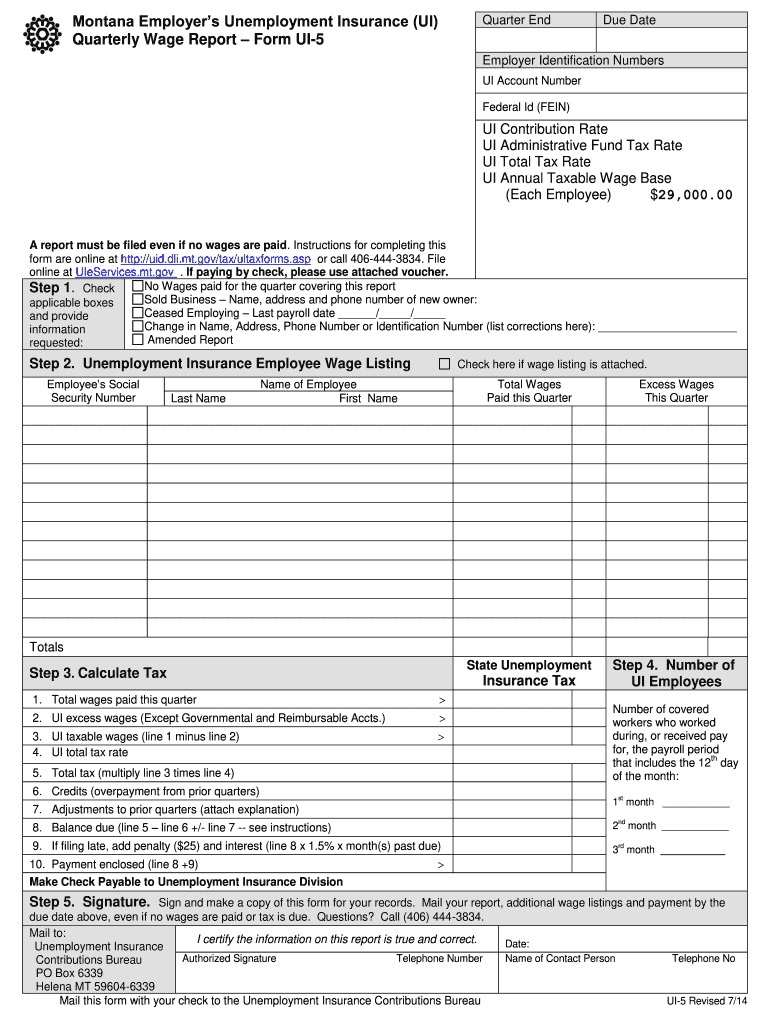

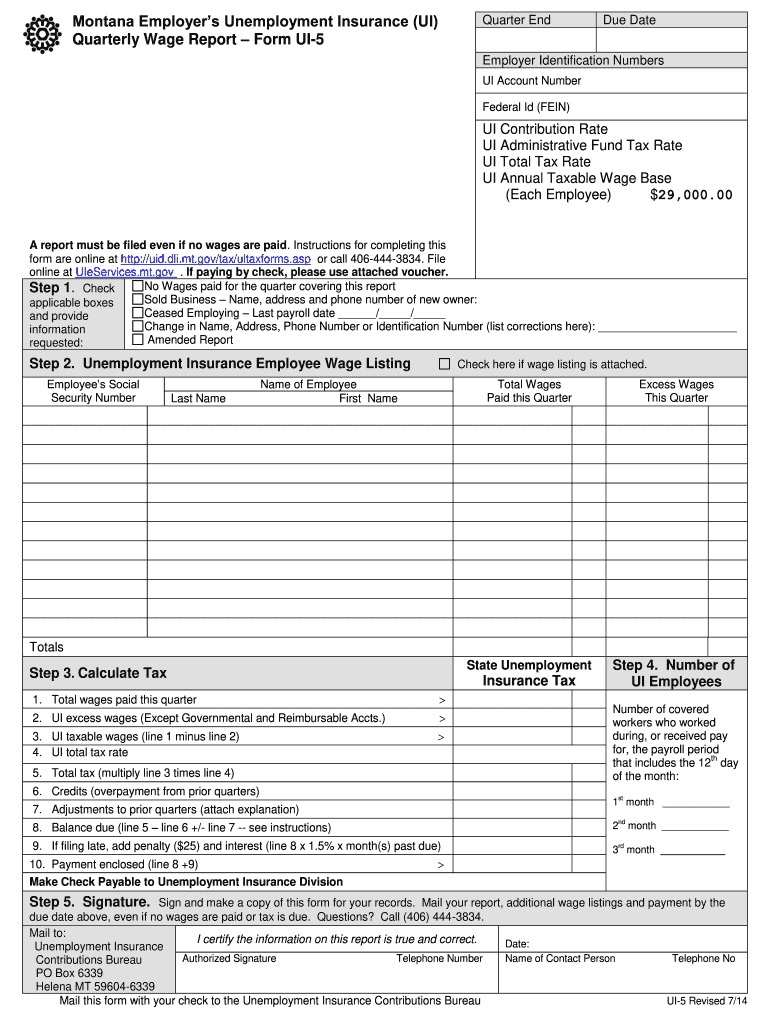

Questions Call 406 444-3834. Mail to I certify the information on this report is true and correct. Unemployment Insurance Authorized Signature Telephone Number Contributions Bureau PO Box 6339 Helena MT 59604-6339 Mail this form with your check to the Unemployment Insurance Contributions Bureau Date Name of Contact Person Telephone No UI-5 Revised 7/14. Montana Employer s Unemployment Insurance UI Quarterly Wage Report Form UI-5 Quarter End Due Date Employer Identification Numbers UI Account...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your freddie mac form 1116 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your freddie mac form 1116 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit freddie mac form 1116 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mt ui 5 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

MT UI-5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out freddie mac form 1116

How to fill out Montana Quarterly:

01

Gather all necessary financial information such as income, expenses, and deductions.

02

Download the Montana Quarterly form from the official website or obtain a physical copy from the Department of Revenue.

03

Fill out your personal information accurately, including your name, address, and social security number.

04

Provide details about your income sources, including wages, self-employment income, and investment earnings.

05

Calculate your deductions and enter them in the appropriate sections, such as student loan interest or mortgage interest.

06

Double-check all calculations and ensure that you have entered all information correctly.

07

Sign and date the form before submitting it to the Department of Revenue.

Who needs Montana Quarterly:

01

Individuals who are self-employed or have their own business in Montana.

02

Montana residents who have income from sources outside of Montana.

03

Non-residents who derive income from within Montana.

04

Anyone who receives rental income from Montana properties.

05

Those who have significant investment earnings from Montana-based assets.

06

Individuals who are exempt from federal income tax but are required to file Montana state tax returns.

07

People with certain types of income that are subject to Montana state taxes, such as gambling winnings.

Note: It is essential to consult with a tax professional or refer to the Montana Department of Revenue for specific guidelines and to determine if you are required to file a Montana Quarterly return.

Video instructions and help with filling out and completing freddie mac form 1116

Instructions and Help about mt quarterly report form

Fill montana ui quarterly wage report : Try Risk Free

People Also Ask about freddie mac form 1116

Is there a state tax form for Montana?

Does Montana have an efile form?

Do I have to file a state tax return in Montana?

What is the Montana income tax withholding form?

Does Montana tax non resident income?

How do I pay my Montana estimated taxes?

Can I pay Montana estimated taxes online?

What is the easiest way to pay estimated taxes?

How do I file for weekly unemployment in Montana?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file montana quarterly?

Employers who are required to withhold Montana income tax from employee wages are required to file a quarterly Montana withholding tax return. This includes employers who are located in Montana and employers who are located outside of Montana but have employees working in the state.

What is the purpose of montana quarterly?

The Montana Quarterly is a literary magazine that features the best of Montana literature, art, and photography. It serves to promote the cultural and literary heritage of Montana, and to showcase the work of both emerging and established Montana writers, artists, and photographers.

What is the penalty for the late filing of montana quarterly?

The penalty for late filing of a Montana quarterly return is 5% of the unpaid tax liability for each month or part of a month the return is late, up to a maximum penalty of 25%.

What is montana quarterly?

Montana Quarterly is a literary and cultural magazine that celebrates the people, places, and stories of Montana, a state in the United States. It features a mix of fiction, non-fiction, poetry, art, and photography that captures the essence of the region. The magazine aims to provide a platform for established and emerging writers and artists to share their unique perspectives on Montana's history, landscapes, communities, and way of life.

How to fill out montana quarterly?

To fill out the Montana Quarterly, follow these steps:

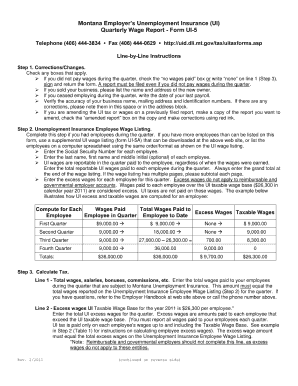

1. Provide the required information: Start by filling out the top section of the form. Enter your business name, address, telephone number, federal employer identification number (FEIN), and account number.

2. Reporting period: Indicate the quarter for which you are filing by marking the appropriate box (1st, 2nd, 3rd, or 4th).

3. Employee information: List all your employees who worked during the quarter. Provide their full names, social security numbers, and wages earned during that period. If you had no employees during the quarter, mark the appropriate box to indicate zero employees.

4. Enter employer contributions: In this section, you need to report any contributions made by the employer, such as retirement plan contributions, insurance premiums, or other benefits provided. Fill in the appropriate amounts in the provided boxes.

5. Calculate taxes owed: Based on the employee wages and employer contributions provided, calculate the taxes owed for the quarter in the corresponding boxes. This may include income tax withholding, unemployment taxes, or other applicable taxes.

6. Total wages paid: Add up the wages paid to all employees during the quarter and enter the total in the designated box.

7. Total tax liability: Add up the taxes owed for each category and enter the total in the designated box.

8. Make payment: If you owe any taxes, enclose the payment in the form of a check or money order with your completed quarterly form. Ensure that the payment is made payable to the Montana Department of Revenue.

9. Signature: The form must be signed and dated by an authorized individual representing the business.

10. Submit the form: Once completed and signed, mail the form with any required payments to the Montana Department of Revenue at the address provided on the form.

What information must be reported on montana quarterly?

Montana Quarterly is a financial report that businesses in Montana are required to file on a quarterly basis. The specific information that must be reported on Montana Quarterly varies depending on the type of business, but generally includes the following:

1. Gross receipts: Businesses must report their total sales or income generated during the quarter.

2. Payroll information: This includes reporting the total wages and salaries paid to employees during the quarter, along with any taxes or deductions withheld, such as federal and state income tax, Social Security tax, Medicare tax, and unemployment insurance taxes.

3. Withholding taxes: Businesses must report the amount of state and federal income taxes withheld from employees' wages and salaries during the quarter.

4. Unemployment insurance taxes: Employers must report the total wages subject to unemployment insurance taxes and pay the required amount of tax.

5. Other liabilities: Businesses may need to report and pay other liabilities such as sales tax, local taxes, or special assessments depending on the nature of their business.

It is important to note that this list is not exhaustive, and businesses should consult the Montana Department of Revenue or a qualified tax advisor to ensure they accurately report all required information on their Montana Quarterly report.

When is the deadline to file montana quarterly in 2023?

The deadline to file Montana quarterly tax returns in 2023 is as follows:

1st Quarter: April 30, 2023

2nd Quarter: July 31, 2023

3rd Quarter: October 31, 2023

4th Quarter: January 31, 2024

How can I send freddie mac form 1116 for eSignature?

To distribute your mt ui 5 form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I fill out mt ui 5 report using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign mt quarterly and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit montana ui quarterly report on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute montana ui 5 form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your freddie mac form 1116 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mt Ui 5 Report is not the form you're looking for?Search for another form here.

Keywords relevant to montana quarterly wage report form

Related to montana ui 5

If you believe that this page should be taken down, please follow our DMCA take down process

here

.